How to Avoid Scams and Recover from Being Scammed

From Nigerian princes to fake Prince Charmings, the world is rife with financial scams. Unfortunately, it only takes one slip of judgement to fall prey to one.

In July 2020 alone, Australians lost over $12M from scams. In just one month, more than 18,500 scams were reported, with around 10 per cent of those involving some type of financial loss (data from the ACCC’s Scamwatch).

Around half of these scams occurred over the phone, while a quarter of them took place via email or over the internet. And though you might think less internet-savvy elderly people are the main victims, data from 2020 so far reveals that all age groups and genders are at significant risk of getting scammed. In fact, it showed younger Australians (aged of 25-44) reported more cases of identity theft than older age groups.

In this guide, we’ll look at the warning signs of some of the most prevalent schemes out there and give you some tips on how to avoid scams. Then, we’ve got some advice for when it’s too late, looking at how to recover from being scammed.

But first, let’s look at some of the most common financial scams that plague us today.

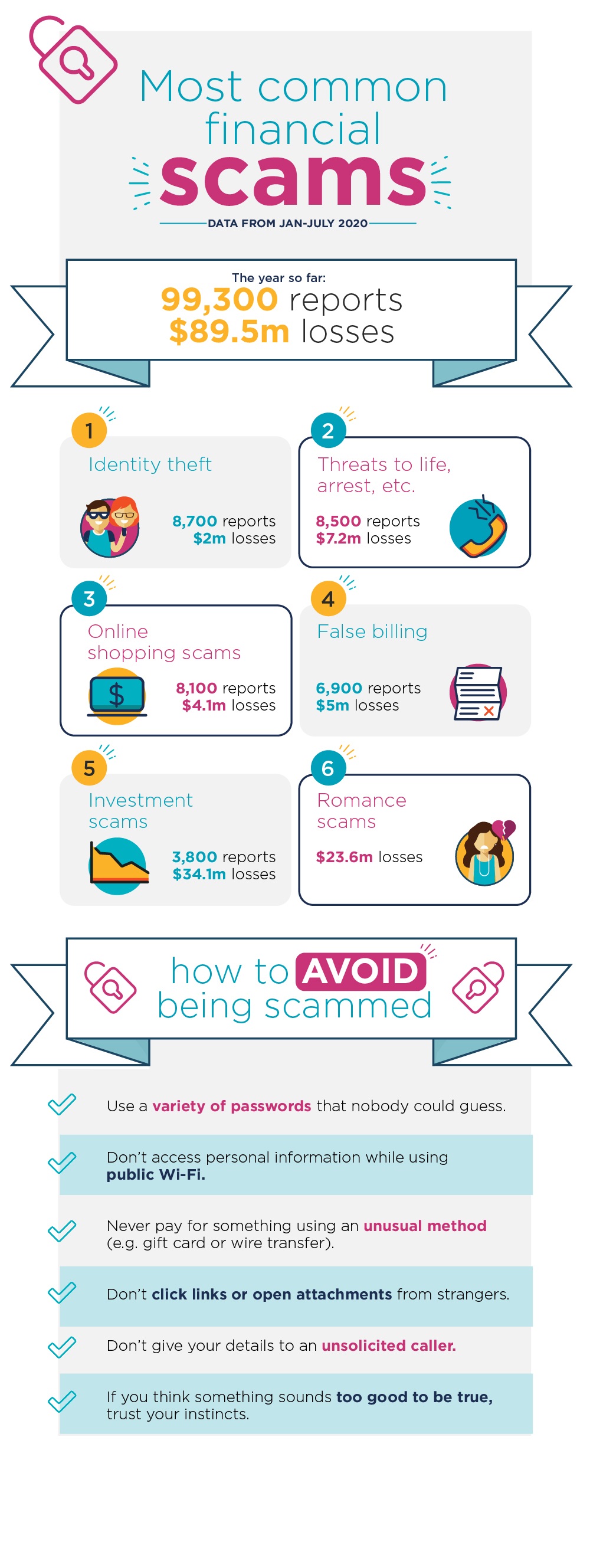

Most Common Financial Scams (Data from Jan-July 2020)

The financial scams causing the most money troubles in Australia include:

- Identity theft (8,700 reports, $2M losses)

- Threats to life, arrest, etc. (8,500 reports, $7.2M losses)

- Online shopping scams (8,100 reports, $4.1M losses)

- False billing (6,900 reports, $5M losses)

- Hacking (4,600 reports, $1.2M losses)

- Investment scams (3,800 reports, $34.1M losses)

- Dating and romance scams (2,300 reports, $23.6M losses).

You should know that the most common scams aren’t always the most dangerous. In terms of financial loss, investment scams and dating/romance scams seem to take the largest toll. From January to July in 2020, they accounted for $34.1M and $23.6M in financial losses respectively.

How to Avoid Scams

Identity Theft

When a scammer successfully steals your identity, they can do a bunch of nasty things in your name – from accessing your accounts and applying for loans, to taking out contracts (e.g. phone plans) and stealing your superannuation.

The most common ways someone might try to obtain the information they need to commit identify theft include phishing, hacking, malware, or even stealing documents.

To avoid identity theft scams:

- Never open suspicious emails or texts

- If you’re unsure if someone contacting you is legitimate, phone the organisation separately to verify their identity.

- Don’t give remote access to your computer to a stranger

- Use a variety of passwords that nobody could guess

- Don’t access personal information while using public Wi-Fi

- Limit how much personal data you post on social media

- Lock your mailbox so that no one can access your bills or bank statements

- Shred personal documents.

Threats of Arrest, etc.

Some scammers will contact you claiming that you owe money (e.g. on a speeding fine or tax office debt). They will threaten you with arrest to pressure you into making a quick payment without thinking it through.

To avoid these kinds of scams:

- Don’t rush into paying before you’ve verified if you actually owe any money

- Never purchase something using an unusual method (e.g. gift card or wire transfer) – a legitimate company or agency would never ask for such a payment

- Hang up and don’t respond to messages

- Call the police if the situation escalates.

Online Shopping Scams

Fake websites, ads and social media pages can trick you into buying things that aren’t what they appear to be – or things that may not even exist.

To avoid online shopping scams:

- Check and read the site’s refund/returns policy

- Stick to Australian retailers when possible

- Only pay for things online via a secure payment service (e.g. PayPal)

- Check for the padlock symbol or https in the web address before making a purchase

- Never agree to pay for items using an unusual payment method (e.g. wire transfer).

False Billing

Often targeted at businesses, false billing scams will try to tell you that you’ve ordered office supplies, advertising spaces, or a domain renewal when your business hasn’t done so.

To avoid false billing scams:

- Never agree to offers over the phone – ask for it in writing

- Never pay an invoice for goods or services before checking that they’ve been delivered

- Restrict the number of people in your business who can approve invoices

- If your supplier’s bank details have changed, contact them to confirm.

- Maintain written records of all your advertising bookings, directory listings, etc…

Hacking

Hackers use technology against you, either by tricking you into installing malware, cracking your passwords, or taking advantage of an unsecured Wi-Fi connection. Once they’ve broken through your device’s security, a hacker could steal your identity, access your personal data, or use your credit card details.

To avoid hacking:

- Keep your devices’ security software up to date

- Regularly run virus checks

- Avoid public Wi-Fi connections when accessing personal data

- Choose tough passwords that aren’t easily guessed and don’t save them on your device

- Don’t click on email links or open attachments from strangers.

Investment Scams

Investment scams take on a variety of forms, from cold calls to seminars, but they all attempt the same thing: to get you (or your business) to part with your money for a questionable opportunity.

To avoid investment scams:

- If you think something sounds too good to be true, trust your instincts.

- Don’t give your details to an unsolicited caller

- Check the ASIC website to verify if the financial advisor holds an AFS licence (ASIC also has a list of companies to avoid)

- Don’t commit to anything during a seminar

- Be wary of anyone that offers a high return with little/no risk.

Dating and Romance Scams

The only thing worse than getting “catfished” online by a stranger pretending to be someone else is getting catfished after you’ve sent money to the scammer. Romance scams involve building an emotional relationship with you via a dating site, often over a long period of time, that eventually turns into requests for money or gifts.

To avoid dating and romance scams:

- Don’t send money to anyone you haven’t met face to face

- Try to remove emotions from the situation if money is requested

- Do a Google reverse image search to see if the person’s profile picture is fake

- Don’t send any images or videos that could potentially be used to blackmail you

- Make sure your family or friends know where you’re going if you make plans to meet your online partner for the first time.

How to Recover from Being Scammed

If you’ve fallen victim to a scammer, it’s natural to feel embarrassed. But this happens to millions of people every year, so it’s nothing to be ashamed of. For the benefit of the community, it’s important to get the word out there by:

- Reporting the scam to the website where it occurred (e.g. share the scammer’s profile or name so they can get flagged/banned)

- Using the ACCC’s report a scam page

- Sharing your story with family and friends so they can learn from your experience.

If you have shared account details with a scammer…

Contact your bank immediately. They should be able to cancel pending transactions, close the account, and perhaps reverse recent transactions. CUA members should call 133 282.

If you think you’ve had your identity stolen…

You can get free help from IDCARE website and accessindividual support services to help you recover your credentials.

If your device has been hacked or infected with malware…

Change all your passwords and use a thorough anti-virus software to check for malware.

If being scammed is causing you anxiety or stress…

There are several resources available to help you through this tough time. For example, Lifeline provides 24/7 crisis support, while Beyond Blue is a fantastic place to get information and advice about depression and anxiety.

Just remember that being scammed is just a small incident in the grand scheme of things. It may feel devastating at the time, but it won’t define your life. Approach it as an unfortunate yet important learning experience, and be more wary of potential scams in the future.

Contact:

Phone:

Email: