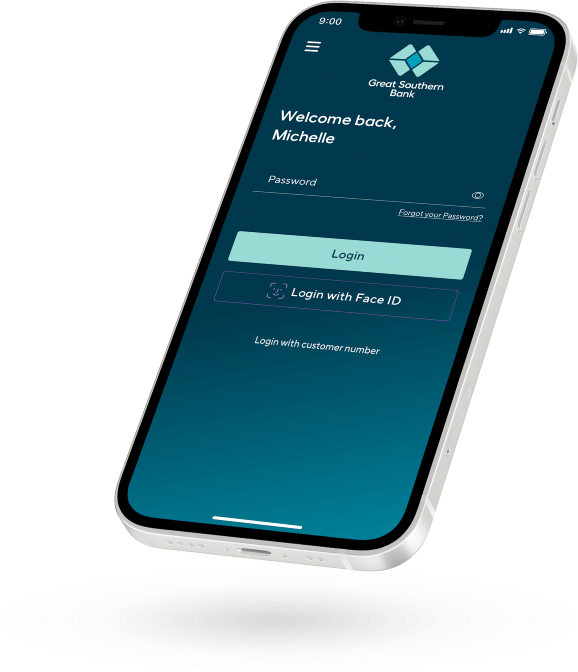

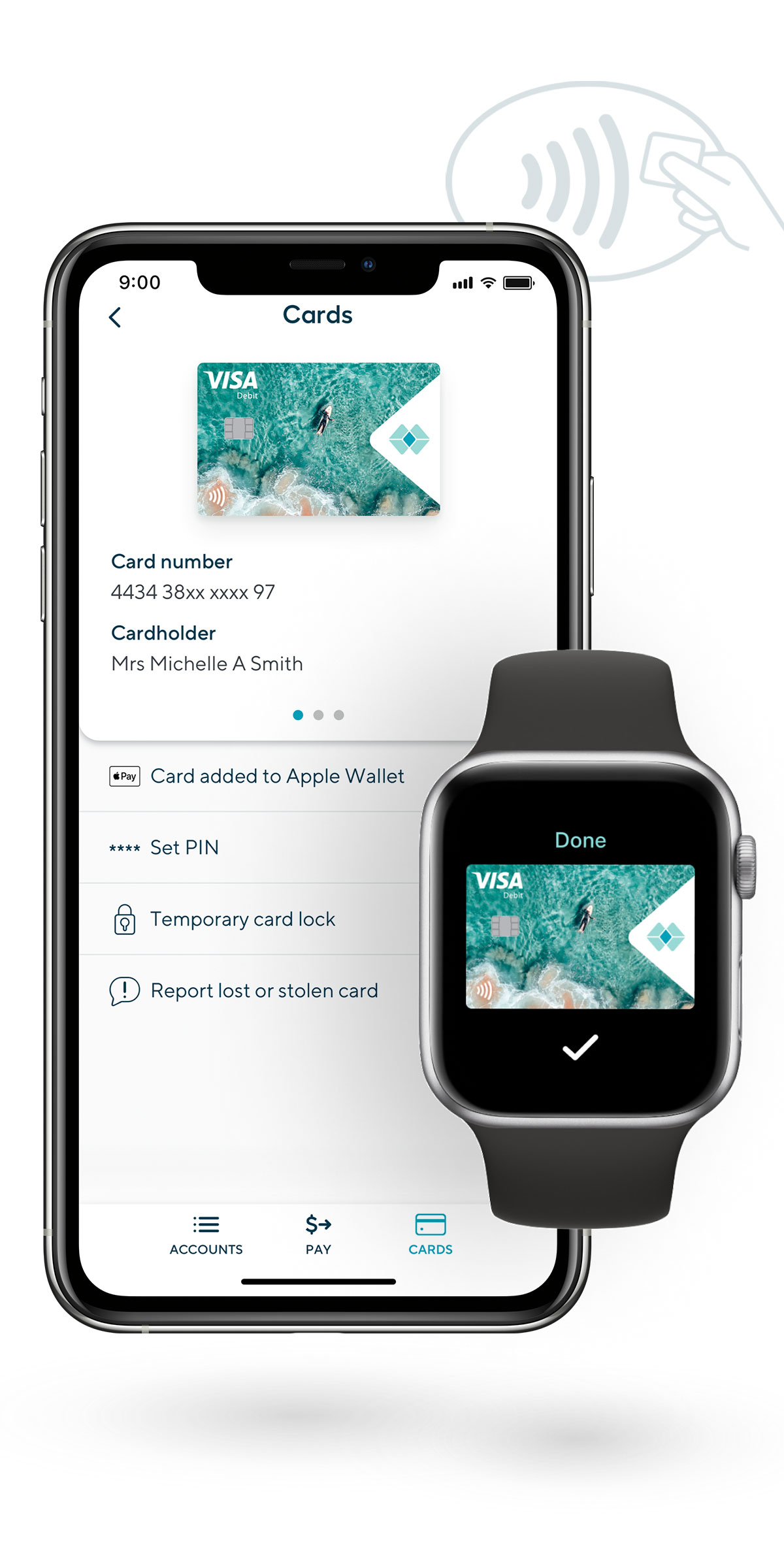

Banking on the go from the convenience of your phone.

Download the app from the App Store or Google Play and get started today.

Do not yet have a password?

Register today