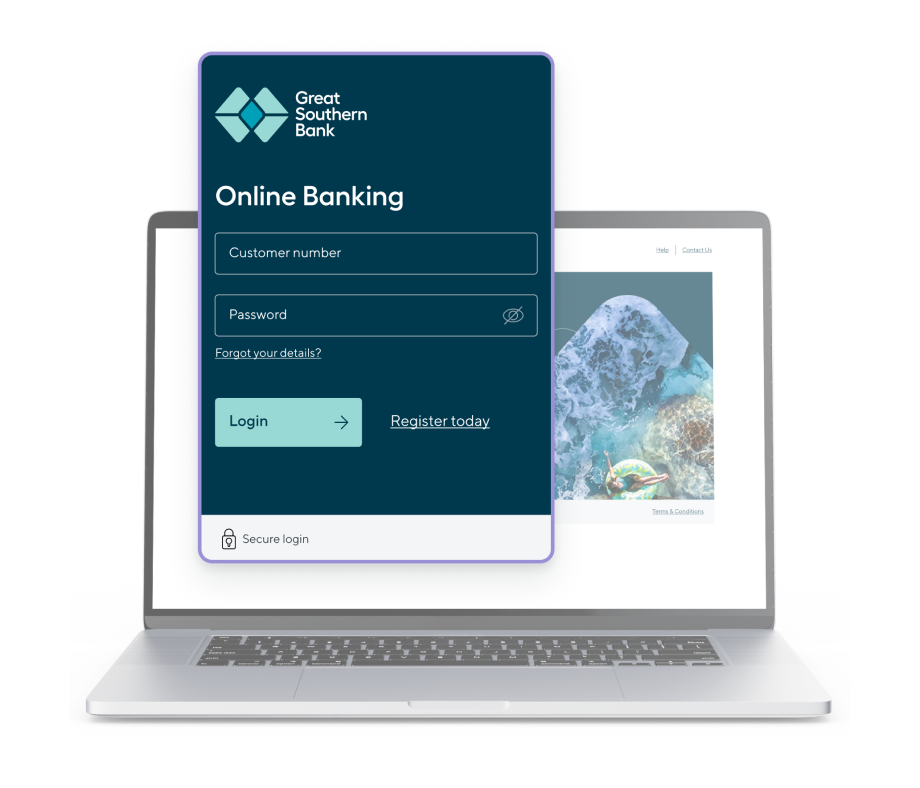

With online banking, managing your money is fast, easy and secure.

Register in less than a minute

and get started today.

and get started today.

Can’t remember your password?

Reset your password